FED QE4 or QE Infinity?

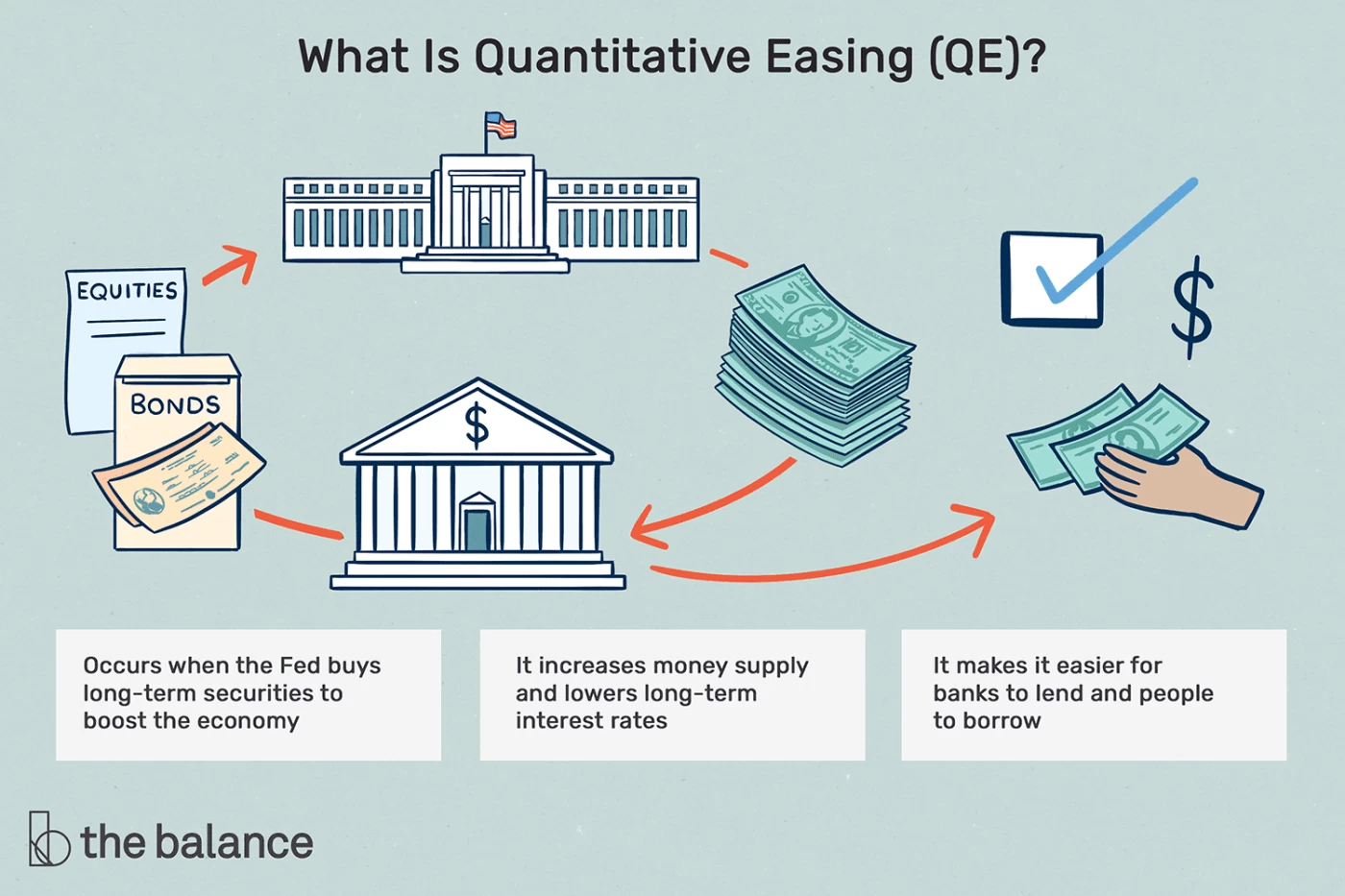

At the beginnig of 2018 the long-awaited QT (Quantitative tightening) was started by the FED. QT in plain words means shrinking the money supply, the opposite of QE (Quantitative Easing) which is expanding the money supply or simply printing money.

QE was the main tool used to stimulate the economy and fight the recession started late 2008. Ben Bernanke was the FED charman back then, and he promissed that QE was just temporary and at some point when the economy is in good shape this will be reverted. Fast forward 10 years and FED chairman is Jarome Powell. At the beginning of 2018 the US FED slowly began to shrink it's balance sheet, year and a half later Aug 2019, the've manage to cut off almost 700 billion dollars, but then something happened.

The US REPO market started to show signs of shortage on liquidity. This is why the REPO interest rate spiked from around 2% to almost 10%. The FED immediately noticed that something is wrong and started the REPO operation, in plain words, they started to lend money to the banks short of money. They did this in order to keep the economy running at the desired FED interest rate, otherwise the market will adjust itself and have higher interest rate which the FED doesn't want.

But then something else happened, the FED started to lower interest rates, they did three 0.25% percent cuts after the REPO rate spike, one per month from SEP to NOV. And then one more thing happened, after the last rate cut the FED announced they will start to purchase Treasuries and start to increase their balance sheet once again. They didn't admit it's QE, because then they'll have to answer the question "why doing QE when there is no recession", but everybody knows this is QE, potentially QE infinity.

It took the FED almost 100 years to grow their balance sheet to $800 billion, but it took them 10 years to multiply this by 5, now the balance sheet is $4.3 TRILLION, $3.5 trillion of 12 years!

Resources:

https://en.wikipedia.org/wiki/Quantitative_easing

https://apps.newyorkfed.org/markets/autorates/tomo-results-display?SHOWMORE=TRUE&startDate=01/01/2000&enddate=01/01/2000

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://mainecorporations.info/

https://www.bloomberg.com/news/articles/2019-09-19/the-repo-market-s-a-mess-what-s-the-repo-market-quicktake